Understanding Shopify Payments: A Comprehensive Guide

Dive into the world of Shopify Payments with our comprehensive guide. Learn everything from setup to managing transactions and maximizing your e-commerce potential.

In today’s rapidly evolving digital landscape, establishing a strong online presence is essential for businesses of all sizes. For many entrepreneurs and small businesses, Shopify has emerged as a go-to platform for launching and managing e-commerce stores. Central to the success of any online store is the ability to accept payments seamlessly and securely. This is where Shopify Payments comes into play.

Shopify Payments is Shopify’s integrated payment solution, designed to streamline the payment process for merchants and provide a hassle-free shopping experience for customers. In this comprehensive guide, we’ll delve into the intricacies of Shopify Payments, covering everything you need to know to make the most of this powerful tool.

Getting Started with Shopify Payments

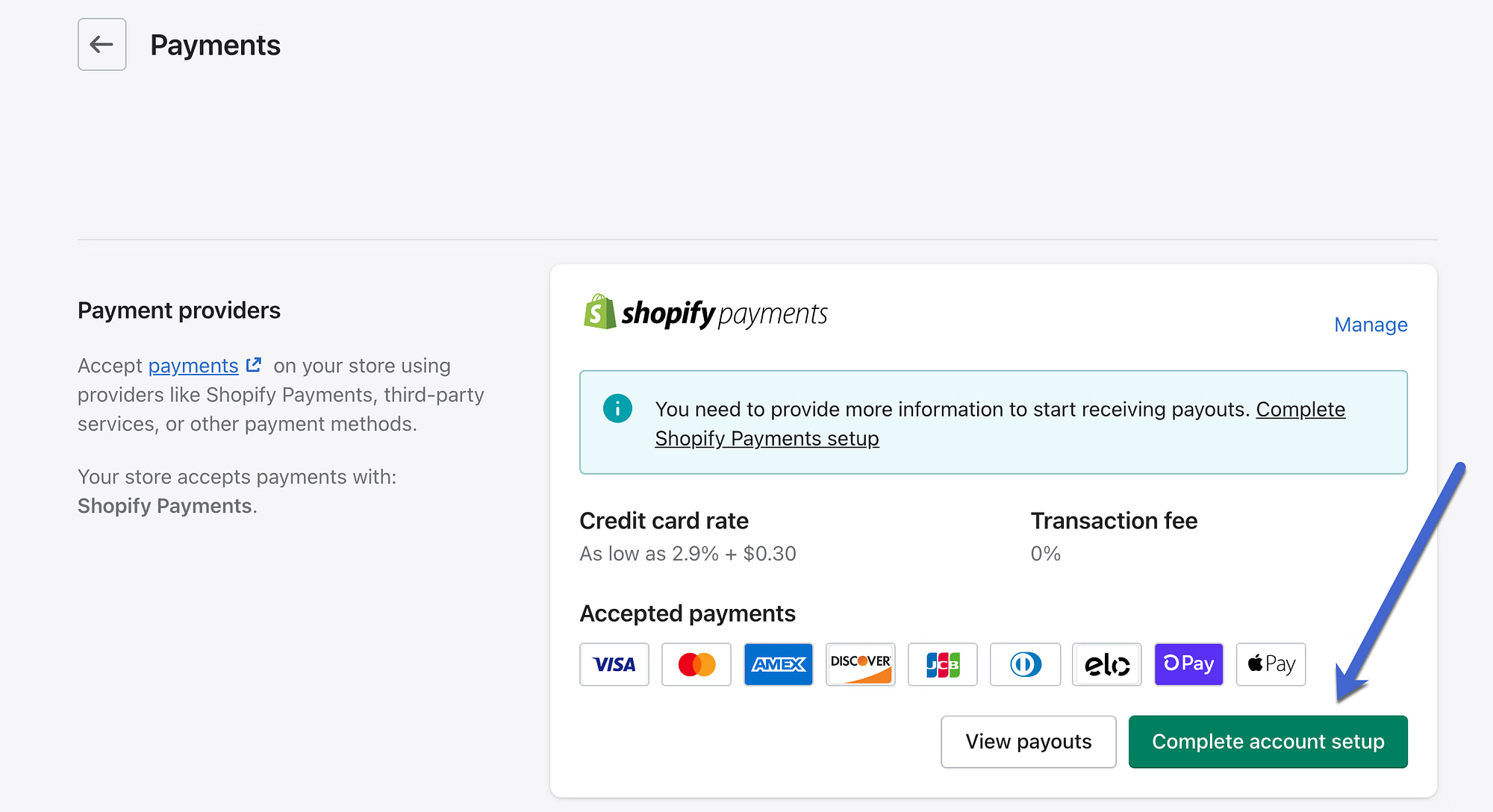

The first step in harnessing the power of Shopify Payments is setting up your payment gateway. Fortunately, Shopify makes this process simple and straightforward. Once you’ve created your Shopify store, you can easily enable Shopify Payments from the admin dashboard. Shopify Payments supports a wide range of payment methods, including credit and debit cards, Apple Pay, Google Pay, and more, ensuring that you can cater to the preferences of your customers.

Understanding Fees and Rates

Like any payment processing service, Shopify Payments comes with associated fees and rates. It’s important to have a clear understanding of these costs to effectively manage your budget and maximize your profits. Shopify Payments offers transparent pricing, with no setup fees or hidden costs. The transaction fees vary depending on your Shopify plan, but Shopify often provides discounted rates for using its native payment solution, making it an attractive option for merchants.

Managing Transactions and Payouts

Once Shopify Payments is up and running, you’ll need to manage your transactions and payouts efficiently. Shopify provides robust tools for monitoring your sales and revenue in real-time, allowing you to track your performance and identify areas for improvement. Payouts are typically processed on a rolling basis, with funds deposited directly into your bank account. With Shopify Payments, you can also issue refunds and manage chargebacks effortlessly, ensuring a positive customer experience at every step of the purchasing journey.

Maximizing Your E-commerce Potential

Beyond its core functionality, Shopify Payments offers a range of features and integrations to help you maximize your e-commerce potential. From abandoned cart recovery to customizable checkout experiences, Shopify provides the tools you need to optimize your conversion rates and drive sales.

Additionally, Shopify Payments integrates seamlessly with other Shopify apps and services, allowing you to automate tasks, personalize marketing campaigns, and scale your business with ease.

Conclusion

In conclusion, Shopify Payments is a powerful tool for merchants looking to streamline their payment processes and enhance the shopping experience for their customers. By understanding the ins and outs of Shopify Payments, you can unlock its full potential and take your e-commerce business to new heights.

Whether you’re just starting out or looking to expand your online presence, Shopify Payments provides the flexibility, reliability, and convenience you need to succeed in today’s competitive marketplace.